Using the SMART Solar Incentives Calculator

The Massachusetts Department of Energy Resources has established the Solar Massachusetts Renewable Target (SMART) program, which will regulate incentives associated with new solar photovoltaic (PV) development in the state, beginning November 26, 2018. This is one of a series of fact sheets designed to help farmers navigate the program.

A SMART incentive calculator is available as an Excel spreadsheet on the MA SMART program website. Click on the Resources tab, and and scroll down to the section labeled “Workbooks”. The first file, labeled SMART BTM Value of Energy Workbook (5.1.18), is the calculator. It will download as an Excel spreadsheet.

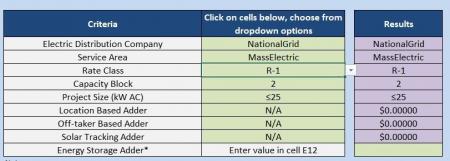

Select the attributes relevant to your project from the drop-down menus. The explanations on the following pages address each criterion in the drop-down menus.

Electric Distribution Company

The electric distribution company is the local utility which bills you for electricity usage– National Grid, Eversource, or Unitil (Fitchburg Gas & Electric). You likely already know the name of your local electricity utility. If not, check the company name on a recent electricity bill. If a municipal light and power company provides you with electricity, you are not eligible for incentives for solar PV through the SMART program.

Service Area

The service area is the part of the state in which your municipality is located, but the zones are defined differently for each utility.

If you are a National Grid customer in mainland Massachusetts, select “MassElectric.” If you live on Nantucket, select “NantucketElectric.”

If you are a Unitil customer, you have only one option – “UnitilFitch.”

If you are an Eversource customer, and live in one of the four counties of western Massachusetts (Berkshire, Franklin, Hampshire, or Hampden), select “WesternMass”. If you live in Cambridge, select “Cambridge.” If you live in Greater Boston, select “GreaterBoston.” If you live on the South Shore, Cape Cod, or Martha’s Vineyard, select “SouthShoreCCVInyard.” If you are not sure whether your municipality is considered part of Greater Boston or the South Shore, check this map. Eversource customers in Cambridge and Greater Boston are shown in dark green, and labeled as part of the NEMA load zone. Eversource customers on the South Shore, Cape Cod, and Martha’s Vineyard are shown in light green, and labeled SEMA.

Rate Class

The rate class defines the type of customer you are, and the rate and tariffs you pay for electricity. In general, R and RD rate classes are for residential customers, G and GD rate classes are for commercial customers, and T rate classes are for commercial customers who pay different rates depending on time-of-use (peak or off-peak hours). However, the rate class names and definitions vary by electric distribution company and service area, so it is important to obtain the correct information for your particular location and account.

- National Grid customer, your rate class should be listed on your bill. See the red box on this sample bill. You can also call your utility to obtain this information for your account. Rate class definitions are available on the National Grid website: Business Residential

- Eversource customer, you can call your utility to obtain the rate class information for your account. Rate class definitions are available on the Eversource website. Western Mass Eastern Mass

- Unitil customer, you can call your utility to obtain the rate class information for your account. Rate class definitions are available on the Unitil website: Residential Business

Capacity Block

As solar PV facilities are installed and solar electricity capacity is added to the grid, SMART program incentives progress through a series of capacity blocks (2-8 blocks in total, depending on the service area). The CLEAResult website lists the current capacity block on the left-hand side of its main page. The capacity block varies by electric distribution company and service area.

If you are a National Grid customer in mainland Massachusetts, the relevant capacity block is listed under Massachusetts Electric d/b/a National Grid. If you are a National Grid customer in Nantucket, the relevant capacity block is listed under Nantucket Electric d/b/a National Grid.

If you are a Unitil customer, the relevant capacity block is listed under Fitchburg Gas & Electric d/b/a Unitil.

If you are an Eversource customer and selected the “WesternMass” service area, the relevant capacity block is listed under WMECO d/b/a Eversource Energy. If you are an Eversource customer in eastern Massachusetts, and selected “Cambridge,” “GreaterBoston” or “SouthShoreCCVinyard” as your Service Area, the relevant capacity block is listed under NSTAR d/b/a Eversource Energy.

Project Size

Determine your proposed project capacity in kW AC. Then select the appropriate project size range which includes your project capacity.

If your project size is ≤25 kW, you should select ≤25 kW or LowIncome ≤25 kW, depending on what type of customers are receiving the electricity (either directly or through net metering). If your project is serving low-income customers receiving a discounted electricity rate from the utility, you are eligible for a higher Base Compensation Rate, and should select LowIncome ≤25 kW for your Project Size. Otherwise, select ≤25 kW. Keep in mind that projects ≤25 kW are not eligible for a location-based adder, an off-taker based adder, or solar tracking adder, so these 3 rows should all be listed as N/A.

Location-Based Adder

Remember, if you select project size ≤ 25 kW or LowIncome ≤25 kW, you are not eligible for a Location Based Adder, and must select N/A.

You can only select one location-based adder. Adders are not available for standard ground-mounted systems, unless they are located on an eligible brownfield or landfill.

Building refers to a solar PV array mounted on a building.

Floating refers to a floating solar PV array installed on a water body that is not a jurisdictional wetland (e.g. reservoir, water-treatment facility).

Brownfield refers to a solar PV array mounted on an eligible disposal site of oil or hazardous materials. See the guideline for more information.

Landfill refers to a landfill that has received an approval from MassDEP for the use of a solar photovoltaic Generation Unit at the landfill as a post-closure use pursuant to 310 CMR 19.143. For more information on post-closure use of landfills, click here.

Canopy refers to a solar PV array installed on top of a parking lot, pedestrian walkway, or canal in a manner that maintains the function of the area beneath the canopy. Note that if your project is located on Agricultural Land, you cannot receive this adder if your project exceeds 200% of on-farm demand.

Agricultural refers to a solar PV array installed in a dual-use framework allowing for continued use of the land under the solar array for commercial agricultural production. The requirements to qualify for this adder are outlined in this guideline.

Your project is only eligible for the Agricultural Location Based Adder if the project is located on Agricultural Land. Agricultural Land includes land with Prime Farmland Soils (as defined by NRCS), property enrolled in a Chapter 61A program, or property that has been enrolled in a Chapter 61A program within the previous 5 years. Note that unless you are granted a waiver by MDAR, you cannot receive this adder if your project size exceeds 2 MW in capacity.

If your project does not meet the qualifications for any of these Location Based Adders, select N/A.

Off-taker Based Adder

If you selected ≤ 25 kW or LowIncome ≤25 kW for your Project Size, you are not eligible for an Off-taker Based Adder, and must select N/A. If your solar PV array is ≤25 kW and provides electricity to low-income housing, be sure you selected LowIncome ≤ 25 kW under Project Size.

CommunityShared refers to a solar PV array that provides electricity or bill credits to three or more electricity customers. Note that the regulations for CommunityShared require that no more than two customers may receive bill credits in excess of those produced annually by 25 kW of nameplate AC capacity, and the combined share of these participants' capacity must not exceed 50% of the total capacity of the array, unless the array is smaller than 100 kW AC.

LowIncomeProperty refers to a solar PV array that provides all of its generation output in the form of electricity or bill credits to low or moderate income housing, as defined under M.G.L. c. 40B

LowIncomeCommunityShared refers to a community-shared solar PV array that provides at least 50% of the energy output to low-income customers receiving a discounted electricity rate from the utility, in the form of electricity or bill credits.

PublicEntity refers to a PV solar array owned by a municipality or other government entity, or an array for which 100% of the electric output is assigned to a municipality or other government entity.

Solar Tracking Adder

If you selected ≤ 25 kW or LowIncome ≤25 kW for your Project Size, you are not eligible for an Solar Tracking adder, and must select N/A.

If your solar PV panels are mechanized to track the sun during the day, select Yes. Otherwise, select N/A.

Energy Storage Adder

MA DOER has a separate calculator to compute the energy storage adder for your particular project. That calculator is available here.

Once you have calculated the adder for your project (in $/kWh), put that value in cell E14. NOTE THAT THE DIRECTIONS IN THE MAY 2018 VERSION OF THE CALCULATOR INSTRUCT YOU TO PUT THE VALUE IN CELL E12, BUT THAT IS INCORRECT. IT SHOULD BE PLACED IN CELL E14.

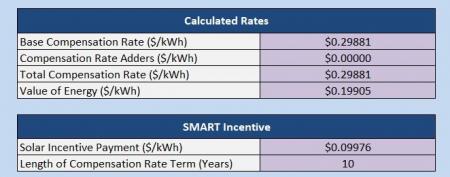

Calculated Rates & SMART Incentives

Base Compensation Rate is the base SMART incentive available for a project of the size you selected.

Compensation Rate Adders shows the sum of the Adders that apply to your project.

Total Compensation Rate is the sum of the Base Compensation Rate and Compensation Rate Adders.

Value of Energy is the value of electricity offered by the utility for your Electricity Distribution Company, Service Area, and Rate Class. This price includes the 3-year average of the Basic Service supply rate, as well as transmission, distribution, and transition costs

Solar Incentive Payment is equal to the Total Compensation Rate minus the Value of Energy.

Length of Compensation Rate Term is the period in years for which you will receive SMART tariff payments. For projects ≤ 25 kW this will be 10 years, for larger projects up to 5 MW in size, this will be 20 years.

What do all these numbers mean?

Behind-the-Meter versus Stand-Alone Installations - The incentive you ultimately receive is partially based on whether your solar installation is set up as a Behind-the-Meter or Stand-Alone installation. The SMART calculator is designed for calculation of incentives associated with Behind-the-Meter solar PV installations, but can also provide rough numbers for Stand-Alone installations.

A Behind-the-Meter facility is one associated with a load, which means that it feeds electricity directly to an on-site building or another type of facility that uses electricity (e.g. an electric car-charging station). A Behind-the-Meter installation can still have net export of electricity to the grid (that is, more can be generated by the installation than is used on site), but must use some electricity on site.

A Stand-Alone facility has no associated load on-site, aside from what is termed “parasitic load” –that is, electricity use that keeps the solar PV installation itself running. For a Stand-Alone facility, all of the electricity generated is fed into the grid, and then net-metered to off-takers of electricity, or sold at a wholesale price.

Behind-the-Meter Facilities

If you have a Behind-the-Meter facility, some or all of the electricity generated by the solar PV installation will be used on-site. You will get the Solar Incentive Payment calculated by the calculator for every kWh your system produces for the entire Length of Compensation (10 or 20 years, depending on the size of the system). The value of the Solar Incentive Payment is fixed, and will not change over the Length of Compensation. In addition, you will gain compensation for the value of the electricity produced, either by using the electricity on-site, or by selling it to other customers or the grid.

If your system is sized to meet about 100% of on-farm demand, you will have little or no net import or export of electricity with the grid. In the summer, when the panels are generating more electricity, you may receive net metering credits on your bill indicating you are generating more electricity than you are using. In the winter, when the panels are generating less electricity, you may be generating less electricity than you are using. Any extra net metering credits you generated during the summer months will be applied to your winter bills. Overall, if you have no net import of electricity from the grid, you should be paying very little for electricity. If your electricity usage is net zero you may still see a small Customer Charge applied to your bill, but if you have a net positive export of electricity to the grid, your net metering credits may cover this charge.

If your system is sized to meet greater than 100% of on-farm demand, you will likely generate more electricity than you can use on-site. This additional energy generation will result in generation of more net metering credits than you can use on site. These credits can be sold to another customer in the same load zone using a private contract, and a percentage of the total net metering credits generated can be assigned to that customer using what is known as a Schedule Z.

If you are in an area where net metering caps have been met, and net metering credits are not available, the equivalent credits will appear on your bill as what are known as “alternative on-bill credits”. If your system is designed to meet much greater than 100% on-farm demand, you can sell electricity to the grid at the wholesale Qualifying Facility (QF) rate.

Stand-Alone Facilities

If your solar PV installation has no associated electricity load on site, it is considered a Stand-Alone facility.

If you are building a Stand-Alone system, the Total Compensation Rate provided by the calculator shows what value the system will receive as a combination of energy and incentive. However, the calculator is meant to provide the Value of Energy and Solar Incentive Payment values for Behind-the-Meter systems only. The Value of Energy and Solar Incentive Payment values generated by the calculator are not accurate for your system. If you are a Stand-Alone system, your Value of Energy will be determined by whether your system is interconnected as a Qualifying Facility (QF), a Net-Metered facility, or an Alternative On bill Credit facility. The Value of Energy will fluctuate with energy market prices, but the Value of Energy plus the Solar Incentive Payment will always equal the Total Compensation Rate.

In the simplest case for a Stand-Alone system, the electricity is sold to the grid by a Qualifying Facility. In this case, the system owner will receive the Total Compensation Rate for each kWh of electricity generated by the system for the Length of Compensation (10 or 20 years, depending on system capacity).

If the electricity generated by the facility is assigned to customers via net metering, the situation is somewhat more complex. The Total Compensation Rate provided for each kWh of electricity generated will be the same, but how that rate is divided between the Value of Energy and the Solar Incentive Payment will change over time. The system owner will receive a Solar Incentive Payment for each kWh of electricity generated, but the value of that Solar Incentive Payment is not fixed over the Length of Compensation period. The customers’ assigned net metering credits will continue to receive a specific percentage of the generated net metering credits, as assigned by a Schedule Z. The generation in kWh assigned to each customer can be expected to follow similar patterns in each year, but the net metering credits dollar value will differ. That is, when the Value of Energy rate increases, due to increases in the price of electricity available through the utility company Basic Service rate, the dollar value of net metering credits will also increase. Since the Solar Incentive Payment is equal to the Total Compensation Rate minus the Value of Energy, it follows that when the price of electricity increases, the Solar Incentive Payment will decrease. This means that the system owner cannot count on a fixed dollar value Solar Incentive Payment for each kWh over the Compensation period. However, most net metering contracts are based on the dollar value of the net metering credits – that is, customers assigned credits agree to pay the system owner a specific dollar amount per dollar credit generated (e.g. $0.90 per $1.00 credit). This means that as electricity prices increase, and the Value of Energy increases, the system owner should gain higher compensation through the net metering contract, even if Solar Incentive Payments decrease.

Greenfield Subtractors

Note that the DOER Calculator does not address “greenfield subtractors.” These can significantly decrease the incentives available for larger projects.

Determining if greenfield subtractors apply to your project.

If your proposed array is a ground-mounted system between 500-5000 kW on open or undeveloped land, it could be subject to a greenfield subtractor. These are dis-incentives that reduce the compensation rate for projects based on the acreage of land developed. There are several characteristics of a large ground-mounted project that could render it exempt from the greenfield subtractor provision.

Exemptions to greenfield subtractors on ground-mounted systems of 500-5000 kW capacity include:

- Systems on Agricultural Land that provide no more than 200% of on-farm demand

- Systems on Agricultural Land that are designed for dual-use of the land for solar PV production and continued commercial agriculture, and that qualify for the Agricultural Location-Based Adder, are not subject to a greenfield subtractor. Typically, these systems can be no larger than 2000 kW, but you could apply for a waiver from MDAR to develop a project up to 5000 kW in size.

- Systems located on brownfields, which qualify for the Brownfield Location-Based Adder.

- Systems located on landfills, which qualify for the Landfill Location-Based Adder.

- Systems located within a solar overlay district, as defined in municipal by-laws.

- Systems located on previously developed land (e.g. previous construction or paving at the site)

If your proposed array does not fall under one of these exemptions, it will likely qualify as a Category 2 or Category 3 project under the SMART program, and will be subject to a greenfield subtractor.

Category 2 applies to projects on undeveloped land that is zoned for commercial or industrial use.

Category 3 applies to projects on undeveloped land that is NOT zoned for commercial or industrial use.

How to calculate the greenfield subtractor:

Category 2: Multiply the planned acreage for your project by -0.0005: ___________________

(e.g., 10 acres * -0.0005 = -$0.005 per kWh)

Category 3: Multiply the planned acreage for your project by -0.001: _______________

(e.g., 10 acres * -0.001 = -$0.01 per kWh subtractor)

Decrease in Adder Values Over Time

The values of Location Based, Off-taker Based, Energy Storage, and Solar Tracking Adders will all decrease by a small percentage over time, in a similar manner to the decrease in Base Compensation Rates which occurs as each capacity block is filled. These adders will be subject to a 4% decrease as each “tranche” is filled; the first tranche is 80 MW in size, but subsequent tranche sizes have not yet been determined. This decrease is not reflected in Adder values as calculated by the calculator. These decreases in Adder values do not impact projects that have already qualified under the SMART program; but are applied to new projects seeking qualification.